RECOMMENDED PRODUCTS

The main chip of N9201 product is up to 1GHz, the processing capacity is 2000DMIPS, and it fully complies with the DVB-C standard. It can integrate various mainstream CA systems such as Yongxin Tongfang, and support home network sharing, middleware, embedded browser and various two-way services. 2D graphics processing, rich multimedia applications.

"Market Manipulation" Theme (4): Trends are mysterious, don't be superstitious about the daily limit

【"Investor Protection·Clarify the Rules, Know the Risks " series 】

Source: Shenzhen Stock Exchange Investment Education Center

Many people are happy to impart such "investment experience" to their relatives and friends: the daily limit of a security at the close of the day indicates that the market has strong demand for the security, and it is more likely to continue to rise in the next trading day. If there are more buy orders that are not traded at the price of the daily limit at the close, the higher the probability of rising in the next trading day, and there may even be a situation where the daily limit rises for several consecutive days. According to this kind of experience, some investors spend a lot of money and energy chasing the daily limit stocks. However, is the daily limit stock really guaranteed to have stable income?

Recently, the China Securities Regulatory Commission's punishment case revealed to us the market manipulation methods of illegal entities using investors' superstitious psychology on the limit-up stocks, and by creating the trend of the limit-up in stock prices, to obtain huge profits. Its main steps include:

l Steadily build positions in relevant stocks;

l Deliberately guide the stock price to approach or reach the daily limit;

l Under the circumstance of knowing that the probability of transaction is very small, continue to apply for a large amount and large amount of purchases at the limit price of the increase;

l After achieving the purpose of attracting other investors to buy, take the opportunity to sell at a high price and make a profit.

The case details are as follows:

Ma XX and Cao XX are the heads of W Investment Company and S Private Fund, respectively, and W Investment Company and S Private Fund share the same office. Ma XX and Cao XX jointly control a total of 38 personal and trust accounts (hereinafter referred to as "account groups"), and conspire to make profits by manipulating the stock price of A shares.

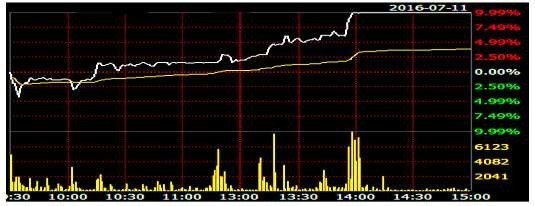

From July 5th to July 12th, 2016, it was the period for the account group to manipulate the A shares and open positions. From July 5th to 8th, the stock price was relatively stable, and the account portfolio bought 9,005,900 A shares. On July 11, the account group started to create a daily limit trend: 14:03:18 to 14:06:13. After raising the stock price to the daily limit, it continued to place a buy order at the daily limit, with a total of 29 purchases totaling 6,009,300 shares. As of the close of the day, the account group had 5,748,600 untraded limit-price buy orders, accounting for 51.73% of the entire market's untraded limit-price buy orders. The stock price trend on July 11 is as follows:

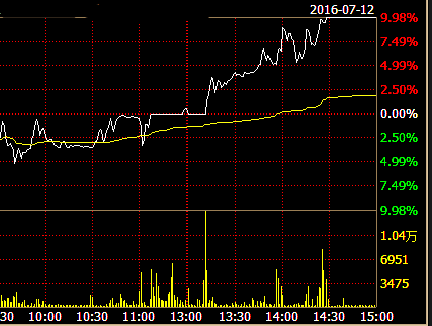

On July 12, the account group copied the trading method on July 11: 14:29:13 to 14:32:34. After raising the stock price to the daily limit, the account group continued to place a buy order at the daily limit, with a total of 23 purchases totaling 509.86 million shares. As of the close of the day, the account group had 3,936,300 untraded limit-price buy orders, accounting for 49.14% of the entire market's untraded limit-price buy orders. A slight difference from July 11 is that on July 12, the account group started to sell during the pull-up process, with a net sale of 1,911,600 shares on that day. See the chart below for the stock price trend on July 12:

On July 13 and 14, A shares were suspended due to abnormal trading fluctuations. On July 15, when trading resumed , the stock price fell by the limit, and the account group sold 94.73% of its holdings on that day, and its holdings decreased from 10,438,500 shares to 486,900 shares; on July 18th, the account group liquidated all the stocks, and the stock price fell 6.48% . In just 8 trading days from July 5, 2016 to July 18, the stock went out of the trend of rapid rise and fall, as shown in the figure below:

Article 77 of the Securities Law prohibits market manipulation and lists four manipulation methods. In this case, XX Ma and XX Cao violated the provisions of Item (1), Item (3) and Item (4) of Paragraph 1, respectively, for “individually or through conspiracy, concentrating capital advantage, shareholding advantage or Use the advantages of information to jointly or continuously buy and sell, and manipulate the price or volume of securities transactions”, “to conduct securities transactions between accounts that are actually controlled by oneself, and to affect the price or volume of securities transactions” and “manipulate the securities market by other means”.

The offender in this case used manipulation to make a profit of 22.88 million yuan in 8 trading days, and was finally confiscated by the China Securities Regulatory Commission and fined a total of 68.65 million yuan. In A-share trading, if investors follow the trend and buy on July 12 or 15, they are likely to suffer large losses in a short period of time. Under the limit-down state, there is even no chance to stop losses. Therefore, for stocks with irrational price changes, investors should comprehensively analyze the company's operating conditions, make horizontal and vertical comparisons with companies in the same industry, and find the basis for the intrinsic value of the stock. The market is over-hyped, forming a good investment habit.

(Disclaimer: The information in this column does not constitute any investment advice, and investors should not substitute such information for their independent judgment or make decisions based solely on such information. Contributors strive for the accuracy and reliability of the information contained in the articles in this column, but do not It does not make any guarantee for its accuracy , completeness and timeliness , nor does it take responsibility for the loss caused by the use . )

Key words: