RECOMMENDED PRODUCTS

The main chip of N9201 product is up to 1GHz, the processing capacity is 2000DMIPS, and it fully complies with the DVB-C standard. It can integrate various mainstream CA systems such as Yongxin Tongfang, and support home network sharing, middleware, embedded browser and various two-way services. 2D graphics processing, rich multimedia applications.

"Market Manipulation" Theme (3): Stock Price Raises Tibetan Routines, Beware of Buying Traps

Source: Shenzhen Stock Exchange Investment Education Center

According to the Shenzhen Stock Exchange 's trading rules , stock auction transactions are matched according to the principle of " price priority and time priority " : price priority means that when the trading system is matched, higher-priced buy orders have priority over higher-priced buy orders. A low-price buy order is filled, and a lower-price sell order has priority over a higher-price sell order; time priority means that for orders with the same buying and selling direction and price, those who declare first have priority over those who declare later. make a deal. Buyers and sellers fully compete to form stock prices, which reflect the pricing discovery function of the market and are also an important reference for other investors to make trading decisions.

In actual transactions, if some investors are optimistic about the value of a stock, they will be willing to increase investment, increase costs, and declare at a price slightly higher than the real-time transaction price to ensure the transaction. Generally speaking, such behavior is a compliant transaction. However, if the stock price is raised significantly, repeatedly, or for a long time by taking advantage of capital, it may constitute market manipulation prohibited by the Securities Law. This is the case in the following case:

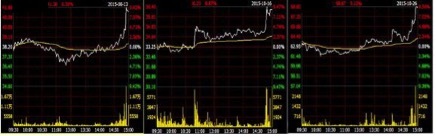

The total amount of funds invested by Xu XX in the market is as high as several hundred million yuan, and he is a large investor . During the last market on August 13 , October 16 and 26 , 2015 , Xu XX controlled and used his own account, took advantage of capital, and traded multiple stocks, which caused the relevant stocks to go out of the trend of strong rise in the last market:

By interpreting the "Decision on Administrative Punishment" issued by the China Securities Regulatory Commission, we found that Xu XX's methods of raising the stock price include:

1. High proportion of declarations and transactions

- The ratio of the subscription volume to the market subscription volume during the period was more than 50%, the lowest was 60.30%, the highest was 74.87%, and the average was 67.96%.

- The ratio of the buying volume to the market buying volume during the period was over 50% , the lowest was 62.73%, the highest was 82.48%, and the average was 73.89%.

2. High-priced entrustment

- The average increase of the price of each order compared to the previous transaction price is 0.24%, the highest is 0.83%, and the average is 0.51%.

- Except for only one declaration on individual stocks, the tier is tier 2, and the rest of the orders are tier 1 . The act of raising the stock price releases a large amount of demand for stock purchases in a short period of time, destroys the full game process between buyers and sellers, forms distorted market pricing, and damages the basic functions of the securities market. If investors have a trading psychology of chasing up and down, or pay special attention to abnormal stocks, they are prone to make wrong investment decisions based on distorted prices. Some illegal entities take advantage of the above psychology to actively create stock price fluctuations and induce counterparties to participate in the transaction, and they themselves sell a lot on the same day or the next day to obtain huge profits.

Article 77 of the "Securities Law" clearly prohibits market manipulation and proposes four situations. Investors who touch this behavior will be severely punished. In this case, Xu XX violated the provisions of subparagraphs (1) and (4) of the first paragraph, respectively, for "individually or through conspiracy, concentrating capital advantage, shareholding advantage or taking advantage of information advantage to jointly or continuously buy and sell, manipulate Securities trading price or securities trading volume" and "manipulating the securities market by other means", using market manipulation methods to lure investors to participate in the transaction, the profit of a single stock in one or two trading days reached more than 4 million yuan, and was finally approved by the China Securities Regulatory Commission . The illegal gains of 37.02 million yuan were confiscated and a fine of 74.03 million yuan was imposed. Investors, especially small and medium-sized investors, should think and make decisions independently in the investment process, and should not follow venture investments without analysis. Don't be tempted by the rapid rise in stock prices and fall into the trap of market manipulators.

(Disclaimer: The information in this column does not constitute any investment advice, and investors should not substitute such information for their independent judgment or make decisions based solely on such information. Contributors strive for the accuracy and reliability of the information contained in the articles in this column, but do not It does not make any guarantee for its accuracy , completeness and timeliness , nor does it take responsibility for the loss caused by the use . )

Key words: